Mobility-as-a-Service operating models continue to evolve and innovate. We consider the current landscape and different scenarios available for cities to deploy.

Mobility-as-a-Service emerged as a way to integrate multiple modes of transport into a single journey, providing options to commuters on how they would like to travel.

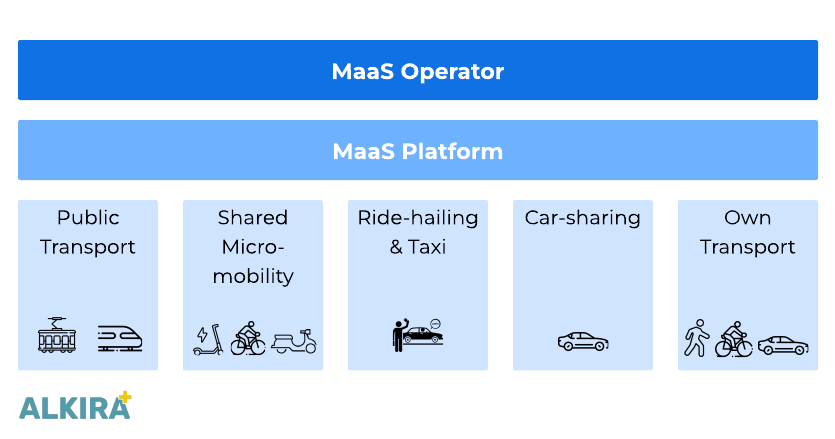

MaaS enables commuters to plan, book, pay, and travel on journeys seamlessly, typically via a single app or interface across multiple modes of transportation, both public (e.g. bus, train, tram, ferry) and private (ride-hail, scooters, bikes, mopeds). It is an aggregator of transportation modes and providers.

The MaaS landscape is characterised mainly by:

1. Who offers and operates the service to consumers?

2. What software platform do they use to achieve that?

3. What modes of transport are offered?

The MaaS operator could be an independent aggregator that does not provide any transport services itself (like Transit, Citymapper or umob), it could be a public transportation provider looking to provide a better experience for their customers, or it could be a private transport provider (like Uber, Bolt or Lime) operating at a local, regional, or global scale.

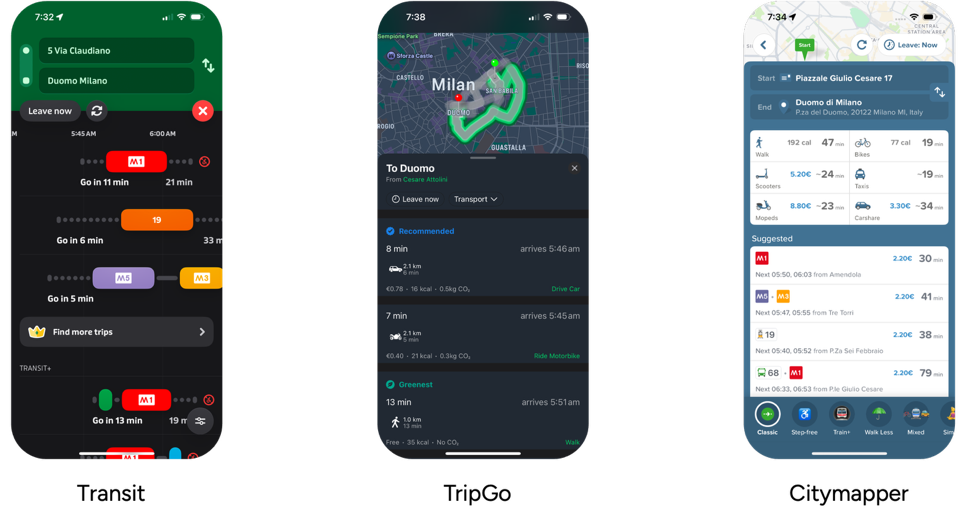

These providers operate no transport services themselves, but aggregate and integrate the transportation services of others, aiming to provide the best and most seamless travel experience direct to consumers. Some offer global coverage, while others are regional only.

Their USPs include 1) having a better UX than transport providers, 2) allowing people to use the same app for multiple cities and countries, and 3) being able to join up and bundle multiple modes of transport beyond what a public or private transport provider can do.

The commercial model has been challenging for these providers, with several no longer operating, despite being early movers in the industry. For the remaining independent aggregators, the commercial model involves taking a commission on transport provider sales, advertising (or paying to remove ads), or charging a subscription for value-added features on the app. Several of the aggregators also white label their platform to cities or provide data services via their APIs, operating as a B2B player.

The independent aggregators don’t own the data and therefore rely on its quality from public and private transport providers. On the one side, they compete with Google Maps and Apple Maps, which offer less MaaS functionality, but are more ubiquitous apps, while on the other side, they compete with both public and private transport providers, which offer fewer transport options, but a more tightly integrated user experience for the services they offer, with consistently better data quality.

Independent MaaS aggregators include Citymapper (owned by Via), Transit, umob, TripGo (by SkedGo), Moovit (owned by Mobileye), Trafi, mapway, Omio, and, to a limited extent, Google Maps and Apple Maps.

National, state, city, or regional transport providers have enhanced their services by offering MaaS apps. Their primary purpose is integrating all owned transport modes into a single service. However, many are increasingly integrating 3rd party private transportation services into their app (e.g. WienMobil includes bike sharing, scooter sharing, car sharing, taxis, car rental and e-charging stations, BVG - Jelbi in Berlin includes scooters, bikes, mopeds, taxis and car sharing).

As publicly owned entities, the objectives of these transport providers extend beyond short-term commercial incentives to consider the goals of the wider community they serve. These goals may include increasing the quantity of public transport and active transport trips to reduce traffic congestion, improving air quality, improving economic productivity and making better use of existing infrastructure investments.

They benefit from owning the transport infrastructure, data, and payment mechanisms. If well-developed, this can offer a very tightly integrated, high-quality service with bundled offers to change the behaviour of travellers.

Their limitations are often a result of how closely they can work with private transport providers such as ride-hailing apps, micromobility providers and others. Additionally, public transport providers are not traditionally consumer app providers or technology integrators, so they either need to procure a B2B MaaS platform or engage external developers to deliver a fully integrated user travel experience. In some cases, this can be done very well, but it requires significant technical capabilities, time, and budget.

For residents of a city or region who commute in a city, a quality MaaS app from a public transport provider that also integrates private transport options is a good choice. It can offer the most reliable and seamless experience as there is no other app to install for their daily commute. Residents also tend to have higher levels of trust in data privacy with government providers.

Public Transport Provider MaaS include SBB Mobile (Switzerland), DB Navigator (Germany), Opal Travel (NSW), S’Hail (Dubai), Breeze (Solent), Wienmobil (Austria), HSL (Finland), BVG Jelbi (Berlin), ODIN Pass (Queensland), Rejsekort (Denmark), Floya (Belgium), TfL Go (London), MVGO (Munich), Choose How You Move (Leicestershire). Mobiliteit.lu (Luxembourg), PTV (Victoria), Bonjour RATP (France), Île-de-France Mobilités (Paris), SSB Move (Stuttgart), GoGoGe (Genoa), Beeline (Singapore), Meep (Madrid) and others.

While many of these companies started in a single transportation domain, they continue to broaden their portfolio to be multi-modal. For example, Uber has ride-hailing and includes access to Lime scooters and bikes. Careem has ride-hailing and e-bikes. Dott & Lime have bikes and scooters. Bolt has ride-hailing, scooters and bikes. Lyft has cars, bikes and scooters.

Very few of these include public transport options such as train, tram and bus, so they are more narrowly focused on improving the use of transport modes they can control and monetise, rather than the community goals such as reducing congestion, air pollution or promoting more active travel.

These providers benefit from convenience, brand awareness, a great UX, and a great data platform. For example, a strong driver of the success of Lime, as the only truly global micro-mobility provider, is that many people choose their scooters from the Uber app.

Private Transport Provider MaaS include Uber (global), Lyft/FreeNow (US/Europe), Didi (global) Careem (Middle East), Dott-Tier (Europe & Middle East), Lime (global), Voi (Europe), Bolt (Global), Jugnoo, Ryde (Nordics), Grab (SE Asia), Yango (Middle East & Africa), Ola (India)

Corporate Mobility-as-a-Service (CMaaS) is a platform that enables companies to offer employees flexible, multimodal transport options instead of or alongside company cars, optimising travel costs, reducing emissions, and improving employee wellbeing. This has also been called Mobility-as-a-Benefit.

For organisations, CMaaS is relevant for reducing Scope 3 emissions, including CO2 emissions from employees’ commutes and business trips.

For example, the Routematic Transport SuperApp (India) operates as an all-in-one control hub for employee transport — handling everything from daily office commutes and visitor travel to event logistics and smart parking. The aim is seamless, stress-free mobility that keeps your workforce moving and always on time.

Private Micro-MaaS meets the needs of specific groups that are not well-served by public and private transport. This includes rural areas, paratransit, university campus transit or travel within a community. Scheduled and on-demand services, or a combination of both, may deliver this.

Examples include Via On-demand transport, Dallas Go-Link, MetroLink Tulsa, Dubai Bus on Demand and Simdle.

Several B2B MaaS software vendors provide the underlying platform to consumer-facing MaaS providers. With the increasing complexity of data feeds from public transit, micromobility and on-demand transit, developing your own MaaS application and ecosystem can be a significant endeavour. White labelling and enhancing a B2B MaaS product can accelerate implementation and significantly lower costs.

MaaS platforms include SkedGo, Trafi, Maasify, Siemens Hacon, Meep, Moovit Solutions, Siemens Padam (for demand-responsive transit) and Via.

As commuting becomes much more multi-modal and cities want to reduce traffic congestion and air pollution, MaaS is likely to be an important part of the transport planning toolkit.

We have outlined several deployment scenarios that a city, region or district may employ, depending on their specific objectives and level of ambition.

Each city is different, and so the MaaS approach needs to match the ambitions, objectives, timelines and budget for that city.

There is a lot of innovation happening in the MaaS space right now as it evolves with the growth of micromobility, car sharing, hardware subscription models and payments. A few highlights below.

Contact us for more details about our MaaS UrbanStack Blueprint that accelerates MaaS deployment for cities. The blueprint includes use cases, benchmark projects, vendor analysis for more than 30 solutions, innovation, costing, ROI assessment, deployment scenarios, roadmap planning, RFI/RFP requirements, and more.